Protect Your Organization

from Financial Fraudfrom

Financial Fraud

Advanced AI-powered solutions for banks and credit unions to detect fraud, reduce false positives, and safeguard assets in real-time.

Stop Synthetic Losses

DeepSecure's Audio Prevention Agent, stops costly deepfake frauds in real-time for contact centers

Reduce Manual Reviews

Our AI-powered platform automates fraud detection and provides clear explanations for alerts

Improve Detection Accuracy

DeepSecure's Audio Prevention Agent, stops costly deepfake frauds in real-time for contact centers

Backed by leading organizations and innovation programs

Why FinOptima

Next-Level AI for Next-Level Threats

Our sophisticated platform provides comprehensive protection against increasingly complex fraud attacks.

Combat Deepfakes and Synthetic Identities

Detect and block advanced fabricated identities that slip past conventional verification systems, preventing fraudulent account openings and financial losses.

Address Real-Time Fraud with Limited Resources

We empower community banks to prevent fraud attacks as they happen without the need for a large in-house team or a custom built in-house solution.

Navigate Complex Data Privacy Challenges

Enables secure fraud intelligence sharing, allowing you to collaborate with other institutions to combat fraud rings without compromising member data privacy.

Our platform

Introducing DeepSecure™

Your Competitive Advantage

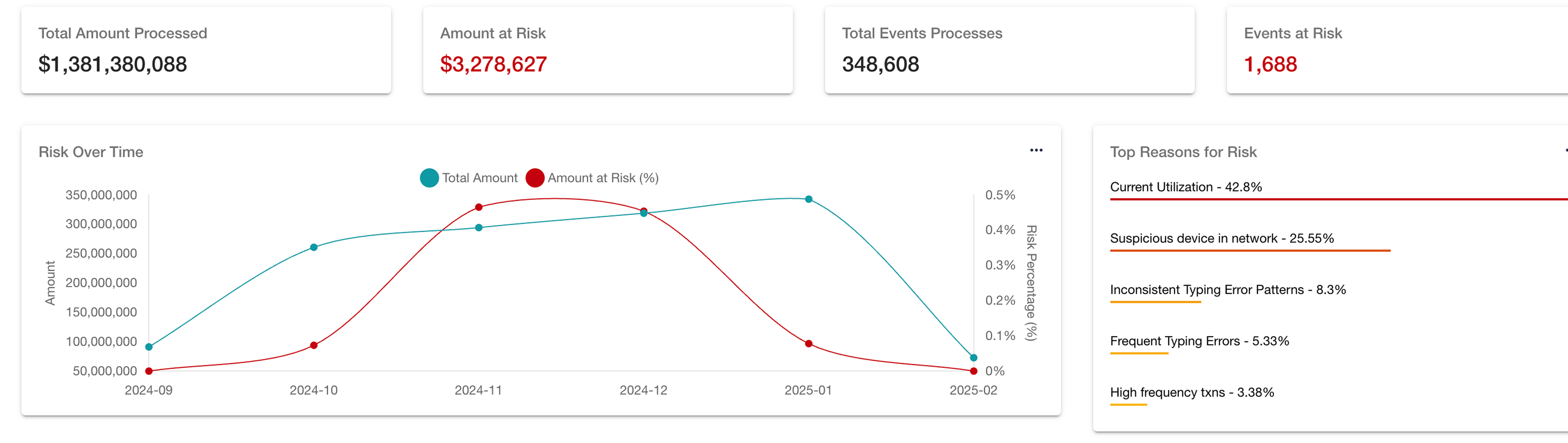

FinOptima's DeepSecure technology delivers advanced AI-powered fraud detection that outperforms legacy systems with faster response times and greater accuracy.

Reduced False Positives

DeepSecure™ reduces false positives by 30% compared to traditional systems, minimizing member disruptions and saving staff time.

Faster Fraud Detection

DeepSecure detects and responds to fraud 50% faster than legacy systems, reducing financial losses and protecting member trust.

Specialized Deep Audio

DeepSecure™'s AI-driven deep audio detection is 95% accurate in detecting deepfake voice impersonation attempts in contact centers

Our Products

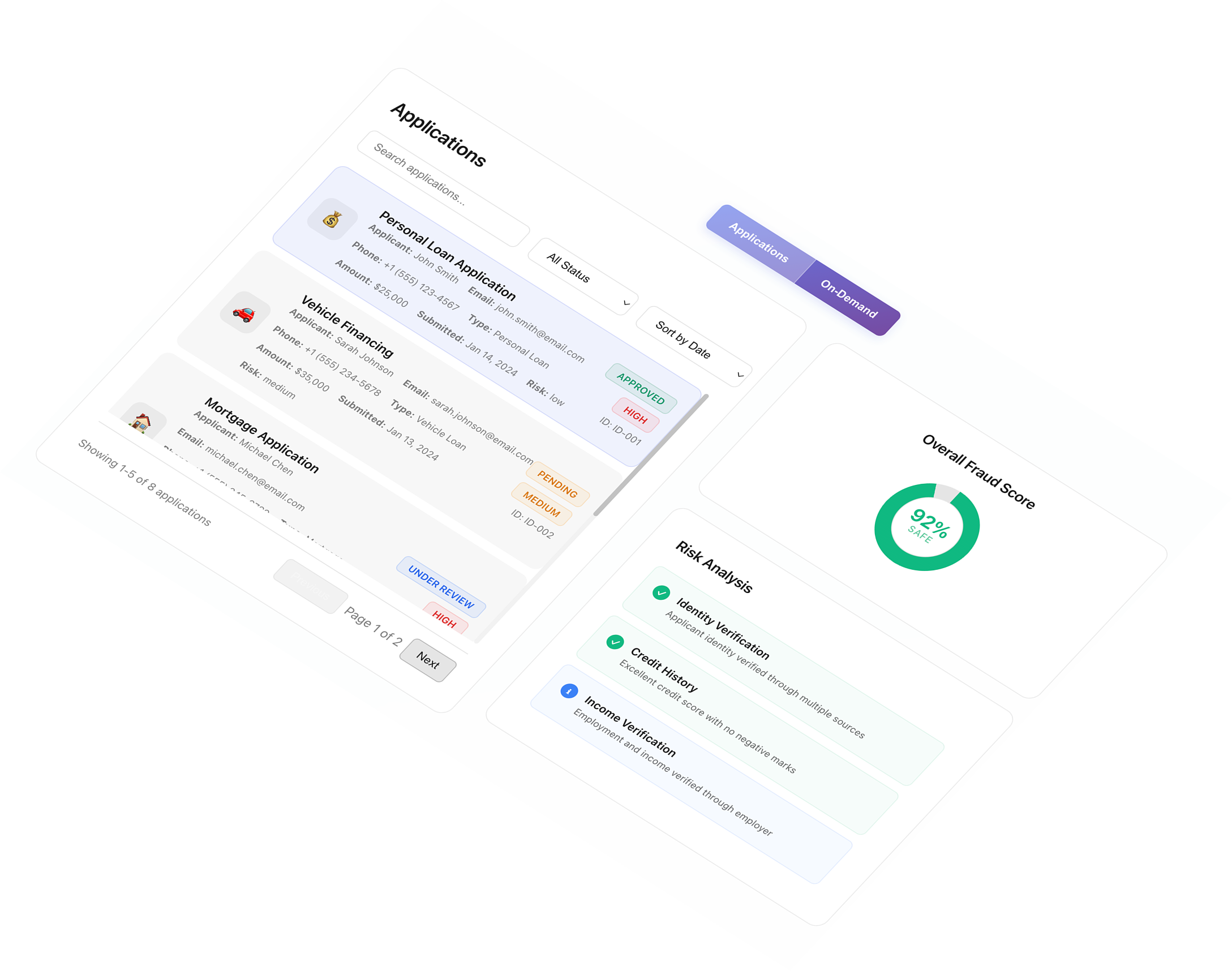

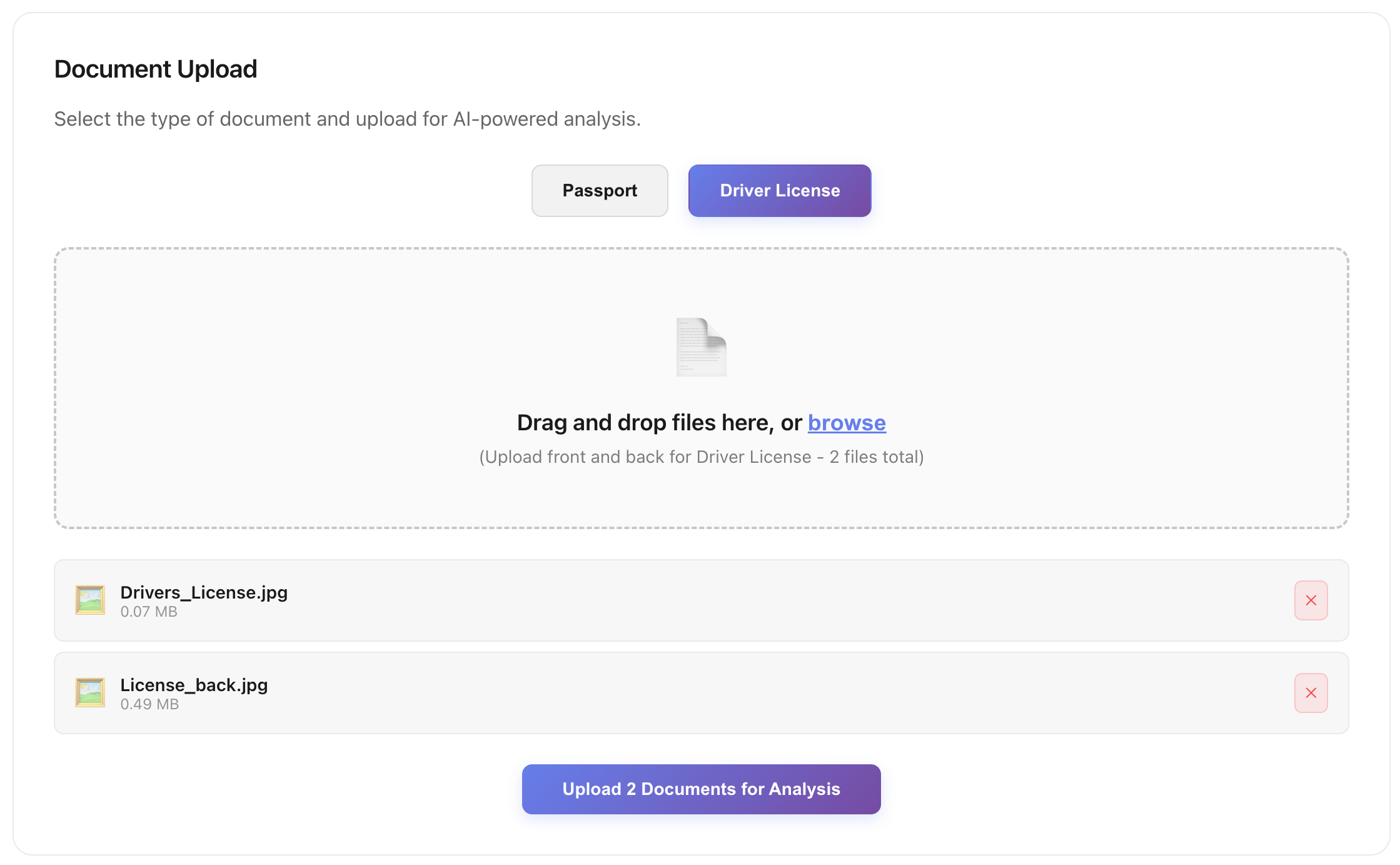

DeepSecure™ Onboard

Intelligent Identity

Verification & Secure

Onboarding

Stop Fraud at the Start

Prevent synthetic identities and deepfake account openings with AI-powered, real-time identity verification.

Seamless, Secure Member Onboarding

Streamline account creation while ensuring compliance with advanced check washing detection and robust identity checks.

Build Trust from Day One

Enhance member experience with fast, secure onboarding, reducing manual reviews and potential fraud risks.

Reduce Losses, Not Members

Prevent costly fraud losses associated with fraudulent accounts and check fraud, protecting your community.

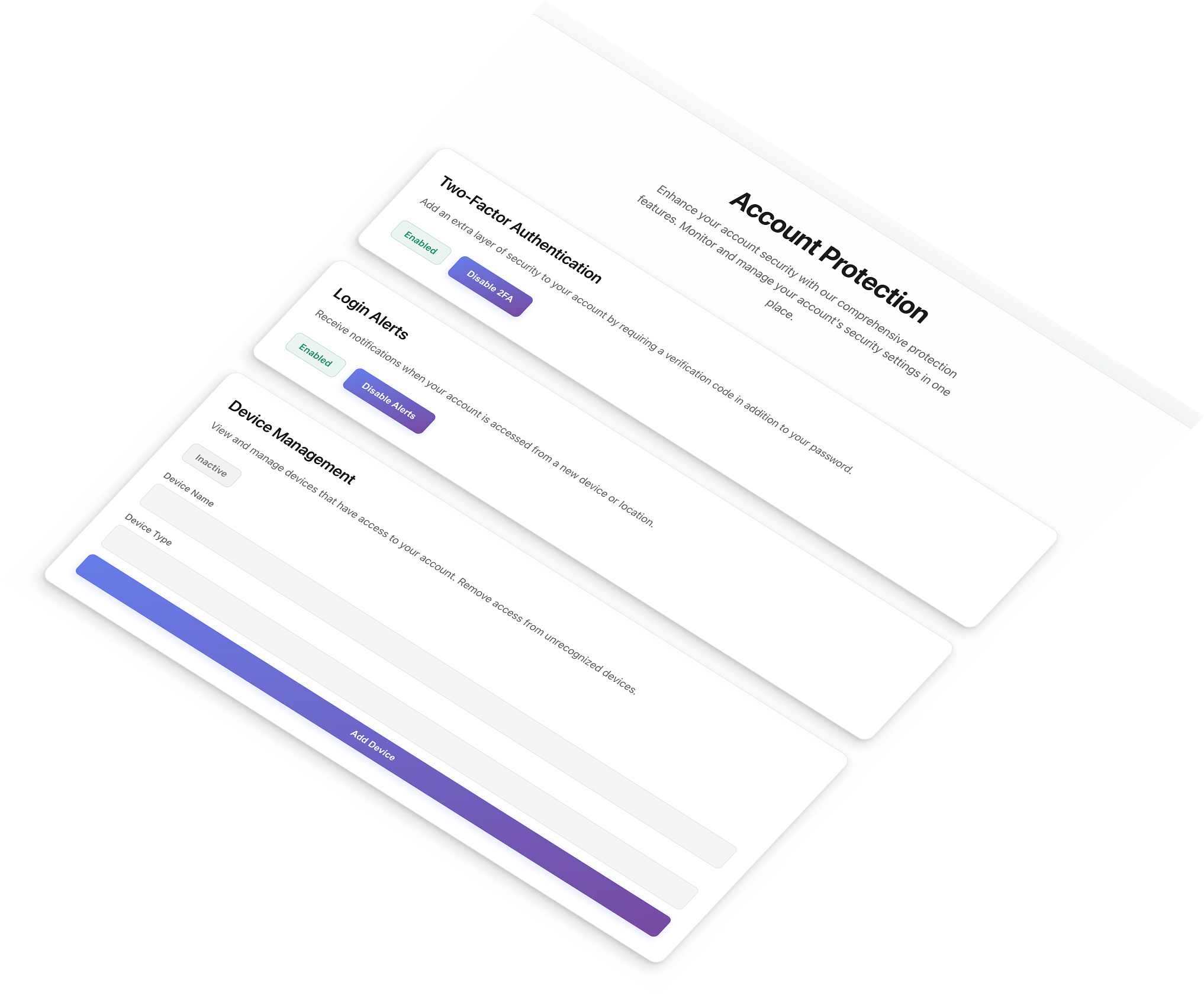

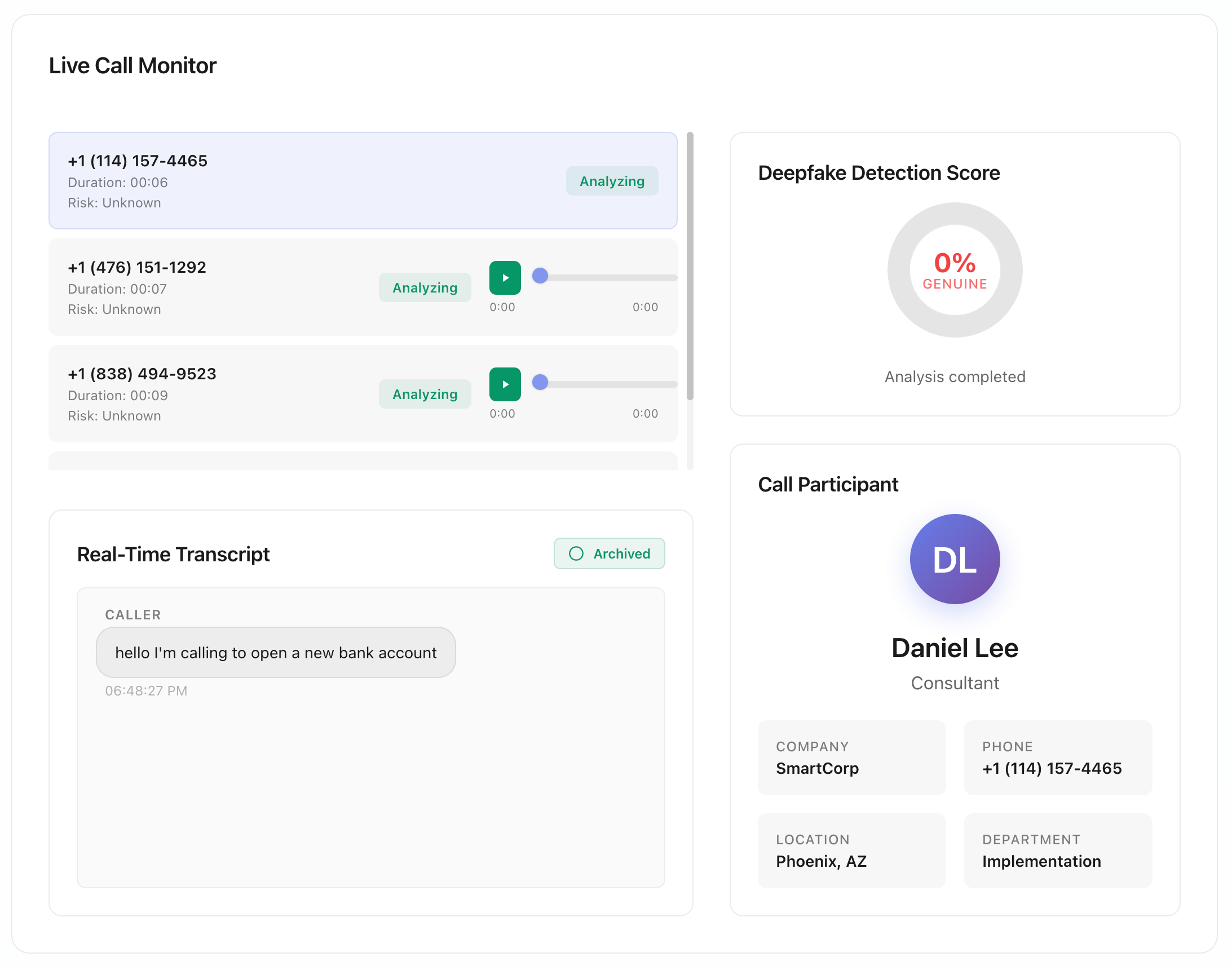

DeepSecure™ Shield

Real-Time Account &

Transaction Protection,

Including Voice Fraud

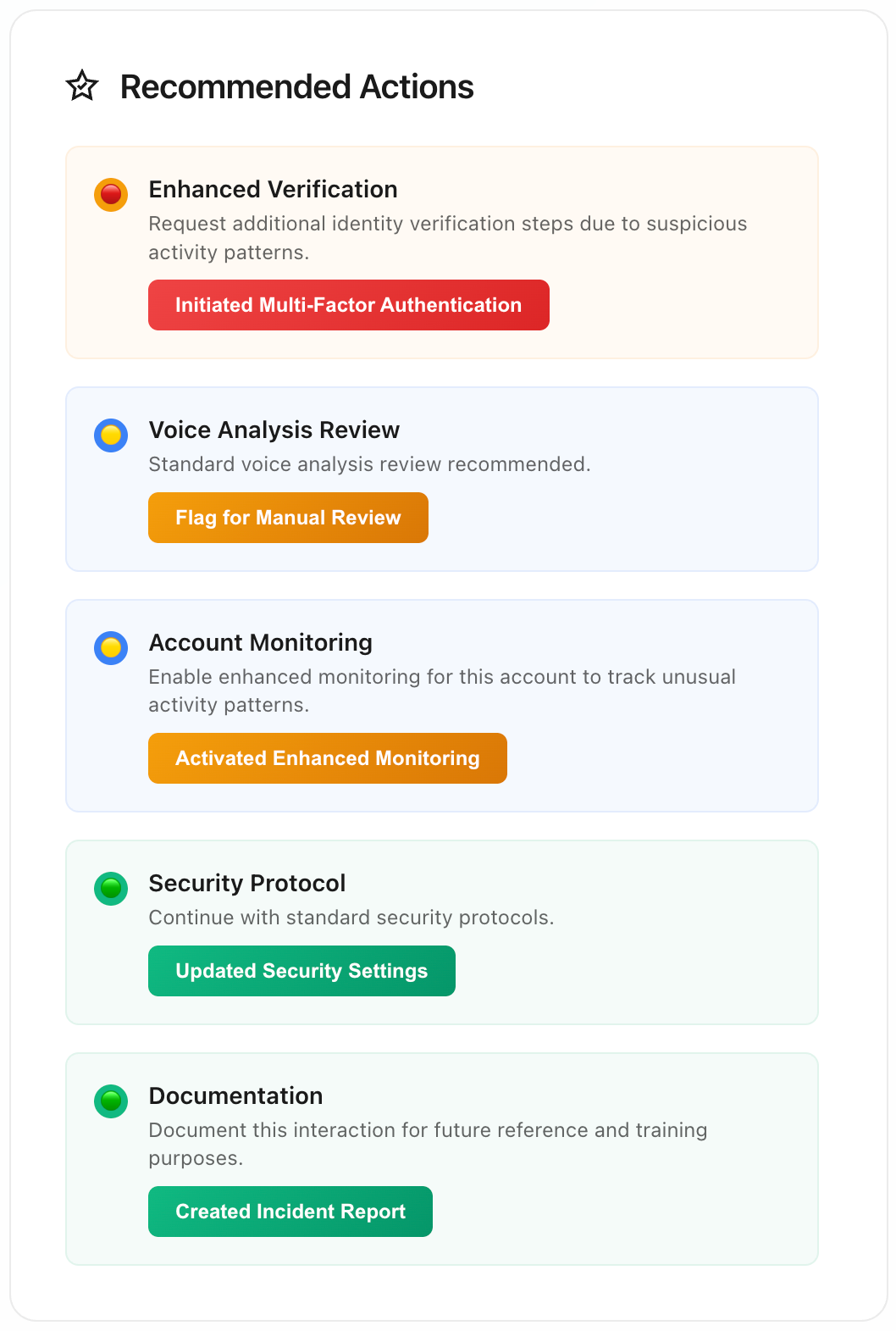

Real-Time Protection, Real Member Trust

Stop account takeovers and fraudulent transactions with AI-driven behavioral analysis and anomaly detection.

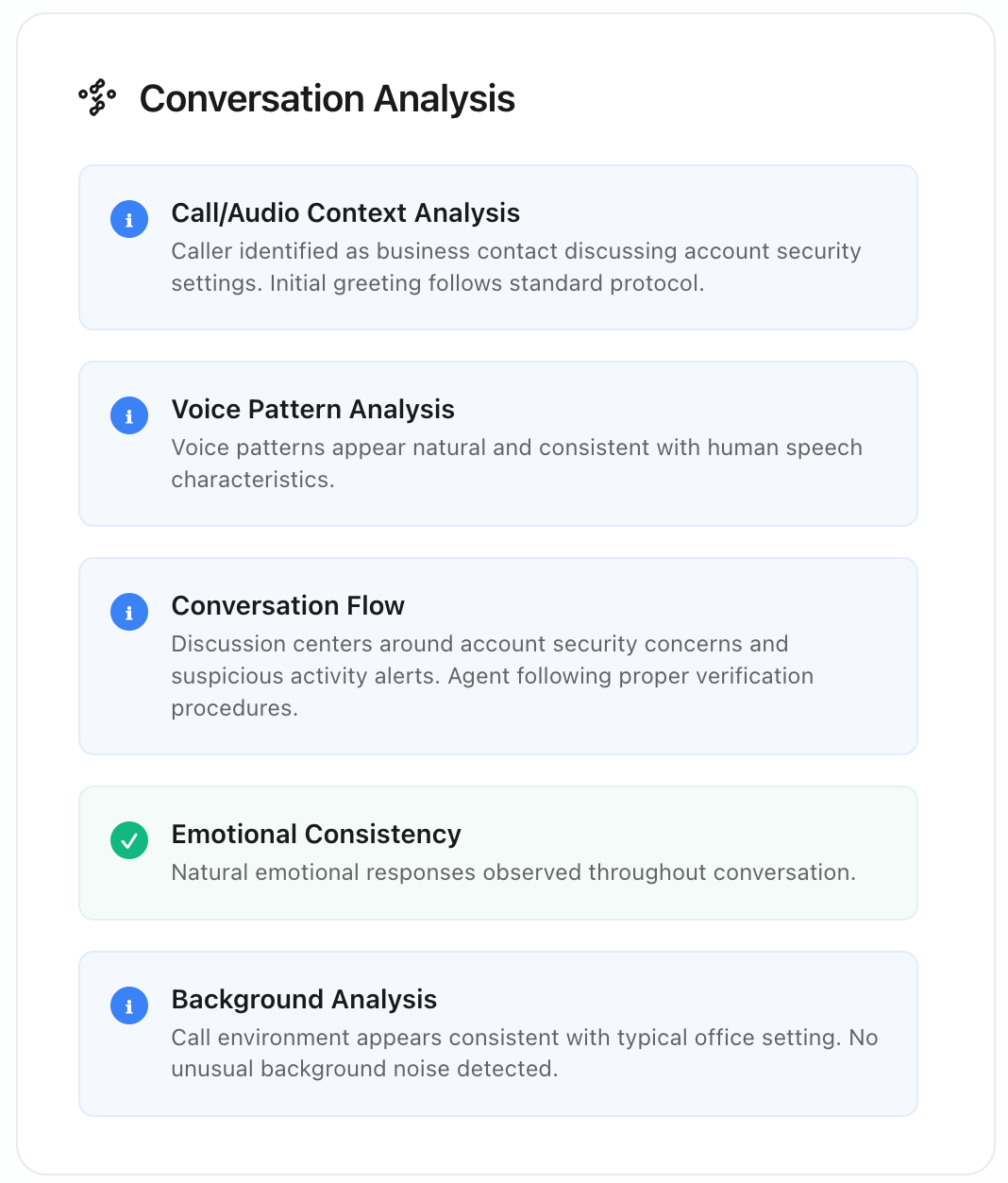

Fortify Your Contact Center

Detect deepfake voice impersonation with DeepSecure™ VoiceGuard, preventing social engineering and protecting member interactions.

Reduce Fraud Losses, Maximize Security

Minimize financial and reputational damage with proactive, AI-powered fraud prevention.

Stay Ahead of Fraudsters

Continuously adapt to evolving fraud tactics with real-time monitoring and adaptive authentication.

DeepSecure™ CheckGuard

Advanced Check Fraud

Prevention

Real-Time Check Fraud Prevention

Detect check washing and alterations instantly with advanced image analysis, stopping fraud before it happens.

Protect Your Assets, Protect Your Community

Minimize financial losses from check fraud with robust, AI-powered image analysis.

Streamline Check Processing

Reduce manual reviews and operational overhead with automated, real-time check fraud detection.

Build Trust in Every Transaction

Ensure the legitimacy of every check with integrated identity verification and advanced image analysis.

DeepSecure™ Network

Collaborative Fraud Ring Detection & Intelligence Sharing

Strength in Numbers

Join a collaborative network to detect and disrupt complex fraud rings with federated learning.

Share Intelligence, Not Member Data

Securely share fraud insights without compromising sensitive data, strengthening community-wide defenses.

Fight Fraud Together

Leverage collective intelligence to combat sophisticated, multi-institution fraud attacks.

Enhance Community Resilience

Build a stronger, more secure financial ecosystem for your members and your institution.

Use Cases

FinOptima's DeepSecure Solving Real-World Threats

Streamlined Account Opening & Onboarding

Multi-layered identity verification for legitimate accounts

Protect from Image-Based Fraud

Identity and Check Image verification

Enhanced Call Center Security

Secure Your Call Center and Protect Customer Data

Secure Loan Approvals

Confidently Approve Loans with AI-Powered Risk Assessment

Streamlined Account Opening & Onboarding

Synthetic identities and fraudulent accounts are on the rise, creating significant risks and costs for financial institutions.

Our multi-layered identity verification analyzes voice patterns, facial features, and document data to ensure that new accounts are legitimate and compliant. This automated approach reduces onboarding time and prevents fraudulent accounts.

Reduce fraudulent account openings by up to 80% and accelerate customer onboarding.

Account Verification

3-Step Process

Meet the Team

Our team of fraud detection experts and AI specialists are dedicated to protecting financial institutions with cutting-edge technology and deep industry knowledge.

Anat Goldstein

Co-Founder & FinTech Strategist

FinTech strategist and co-founder with an MS in FinTech from NYU Stern. Background in investment banking (M&A, capital raising), VC/PE, and RegTech innovation. Angel investor and judge in the Most Fundable Companies Competition, bringing global, cross-sector expertise to financial risk and compliance.

Biswajit K. Lima

Chief Technology Officer

Financial services technology leader with 20+ years of global experience building scalable fraud and risk platforms. EMBA from Brown University, Advanced ML/AI from Stanford. Former NASDAQ, Deutsche Bank, Barclays, and Macquarie Bank.

Farook Sattar

Senior Researcher and Advisor

30+ years of research experience with 150+ publications in signal and image processing, speech/audio, vision, and AI/ML systems. PhD from Lund University. Former engineer, educator, and research scientist.

Fraud Defense Insights

Stay informed with our latest insights on fraud detection, AI innovation, and financial security trends.

Introducing DeepSecure™: Next-Generation Fraud Defense Infrastructure

Our proprietary and patented next-generation fraud defense platform for Community Banks and Credit Unions, specifically designed to counter evolving and sophisticated threats.

Read ArticleThe Illusion of Coverage: Why 'One Tool for Every Problem' Isn't Working

Discover why fragmented fraud prevention tools create dangerous gaps and how integrated systems detect coordinated fraud attempts.

Read More →How Modern Fraud Prevention Can Boost Community Banks' ROI

Discover how fraud prevention transforms from a cost center to a strategic opportunity, potentially saving community banks $145K+ annually.

Read More →Contact Us

For a demo, get in touch with us through our contact form or email us directly at info@finoptima.ai

We will get back to you soon.

We value your privacy. To learn more, visit our Privacy Statement.